Welcome to Part 10 of our series on The Power of Strategic Planning.

For weeks now we have been working on the process of defining a strategic plan for your business and showing you why it is an essential process that provides a roadmap for achieving long-term goals and objectives. However, even the most well-thought-out strategic plan is useless without effective implementation. To ensure that your strategic plan becomes a reality, you need a clear and detailed implementation timeline. In this blog, we’ll guide you through the steps of creating a timeline to help you execute your strategic plan successfully.

Understand Your Strategic Plan

Before diving into creating an implementation timeline, it’s crucial to have a comprehensive understanding of your strategic plan. This means knowing your goals, objectives, strategies, and tactics. If your plan includes multiple components or initiatives, break them down into easy-to-understand and manageable steps. This understanding forms the foundation for your timeline.

Identify Key Milestones

To create a timeline, you need to identify the key milestones or major events that need to occur to achieve your strategic goals. These could include launching a new product, reaching a certain revenue target, or expanding into a new market. Milestones serve as checkpoints to track progress and ensure that your plan is on the right path.

Set Realistic Timeframes

Setting realistic timeframes is critical to a successful implementation timeline. Consider the complexity of each milestone and the resources available to you. It’s essential to balance ambition with practicality. While it’s good to challenge your organization, being overly optimistic about deadlines can lead to disappointment and failure. In the Elon Musk biography by Walter Isaacson, he writes about Elon’s ability to set unrealistic goals for his teams at SpaceX and Tesla, but this is the exception to the rule. In most cases, your team needs to believe the timeframe for the goal is achievable and that the resources necessary to achieve the goal are in place.

Define Responsibilities

Assign responsibilities for each milestone. Clearly define who within your organization will be responsible for driving progress and achieving the associated objectives. Having specific individuals or teams accountable for various tasks ensures that everyone is on the same page and can track progress effectively. Get their input when establishing the timelines and the process for measuring the progress of the tasks assigned.

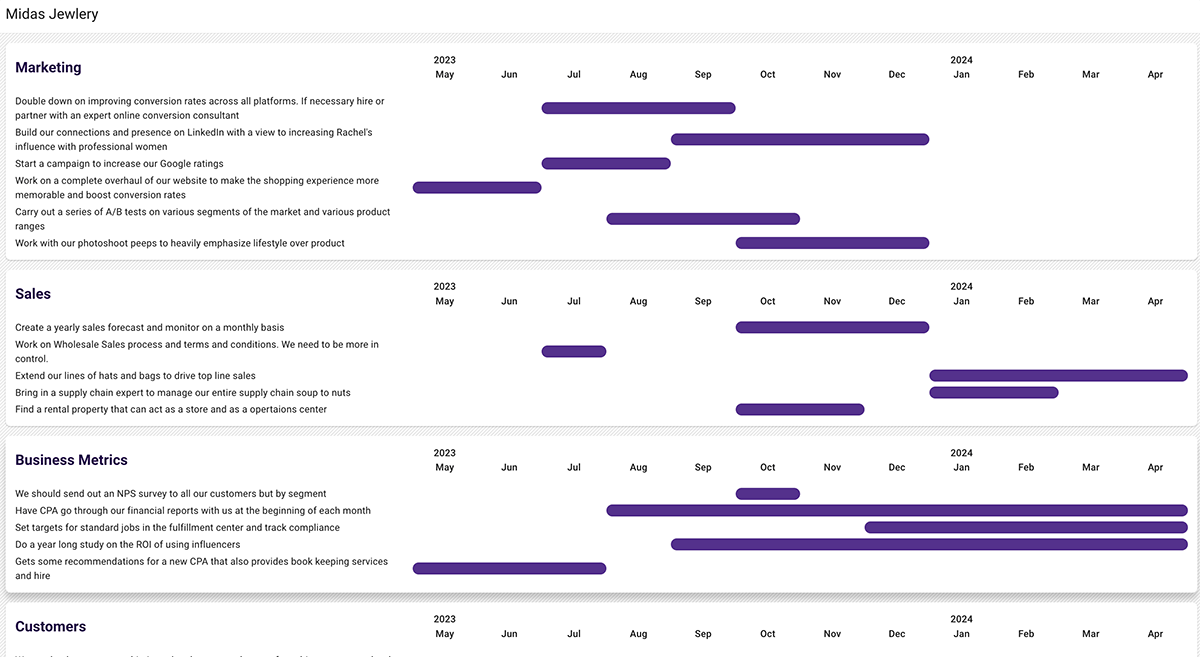

Establish a Gantt Chart

A Gantt chart is a popular tool for visualizing your implementation timeline. It provides a timeline view of tasks, their start and end dates, and how they interrelate. Using software or project management tools, you can easily create a Gantt chart that visually represents your plan’s implementation schedule. Using automation to keep the entire organization on track to complete the tasks assigned is an excellent idea. When working with a client I often recommend Ninety.io. This is a terrific way to keep everyone on track and even sets scheduled check-in meetings with simple agendas to keep everything moving in the right direction.

Allocate Resources

Ensure that you have the necessary resources, including budget, personnel, and equipment, to execute your strategic plan. Resource allocation should align with the milestones in your timeline. If you find resource gaps, address them early to prevent delays.

Monitor and Adjust

Once your implementation timeline is in place, your work is far from over. Regularly monitor progress and be prepared to adjust the timeline as needed. Unexpected obstacles, resource constraints, or changes in the business environment can affect your plan. By staying flexible and adaptive, you can make necessary adjustments to keep the plan on track. I cannot stress enough the importance of scheduled check-in meetings with set agendas. Your entire team needs to know they are being held accountable to complete their assigned tasks on time. If things have gone off track, they need to be out in front of it with an explanation of why they are off track and a plan to get the task completed.

Communicate and Engage

Clear communication is essential throughout the implementation process. Share the timeline with your team and stakeholders. Regularly update them on progress and any changes to the timeline. Engage your team in discussions about challenges and solutions. Effective communication ensures that everyone is aligned with the plan and committed to its success. Communication should be collaborative, not competitive. If there is another team that can help, they should be encouraged to jump in. This is not an individual sport, and you can only win if the entire organization is willing to pitch in to make this a reality.

Celebrate Achievements

As you achieve milestones along the way, take the time to celebrate these accomplishments. Recognizing and rewarding the efforts of your team can boost morale and motivation. It also reinforces the commitment to the overall strategic plan. Your celebrations should not be limited to the management or leadership group. Everyone in the company can contribute, even if only in a supportive way. I will never forget the billing administrator working for me that literally drove revenue by reporting billing progress to the sales and management team throughout the month. She actively became part of the solution and took pride in her contribution to the overall success of the plan to increase revenue by a percentage or two each month. A failure to recognize this kind of buy-in would be a catastrophic mistake. After all it is the employees that accomplish the work not the managers!

Evaluate and Learn

Once your strategic plan has been fully implemented, it’s important to evaluate its success. Did you achieve the intended goals and objectives? What worked well, and what didn’t? Use this evaluation to inform future strategic planning processes and improve implementation timelines for the next cycle. Feedback is important here; everyone should have the ability to add constructive feedback. You can make this part of the annual review process.

In conclusion, creating an implementation timeline for your strategic plan is a crucial step in realizing your organization’s long-term objectives. It provides structure, accountability, and a clear path to success. By understanding your plan, setting realistic timeframes, defining responsibilities, and remaining adaptable, you can increase the likelihood of achieving your strategic goals. Remember that the journey from planning to execution is a dynamic process, and a well-crafted timeline will guide you through it effectively.

For help with your business roadmap reach out any time at the TEC Resource Center or build your roadmap with our newly launched Business Roadmap software. Until next time we wish you much success in whatever path you choose.